(MILAN / SENIGALLIA) – December 1, 2022 – In 2022 Italy made impressive progress again in adopting digital identities according to research just published by Digital Identity Observatory at the School of Management of Milan Polytechnic University. Detailed research results based on in-depth empirical research and analyses were presented in the conference “Digital Wallet: Identity (r)evolution” on November 11, 2022 and are highlighted in this article. This year the conference was specifically addressing work on the proposal towards a European Digital Identity Wallet (EUDI Wallet).

Namirial is supporting the work of the interdisciplinary think tank of professors, researchers and analysts in which key matters of digital innovation are being addressed from its inception. Namirial experts are contributing their expertise into this research project.Namirial Managing Director International Markets Antonio Taurisano is sharing his global experience in digital identity thanks to Namirial’s engagement in digital trust services on pan-European level and beyond.

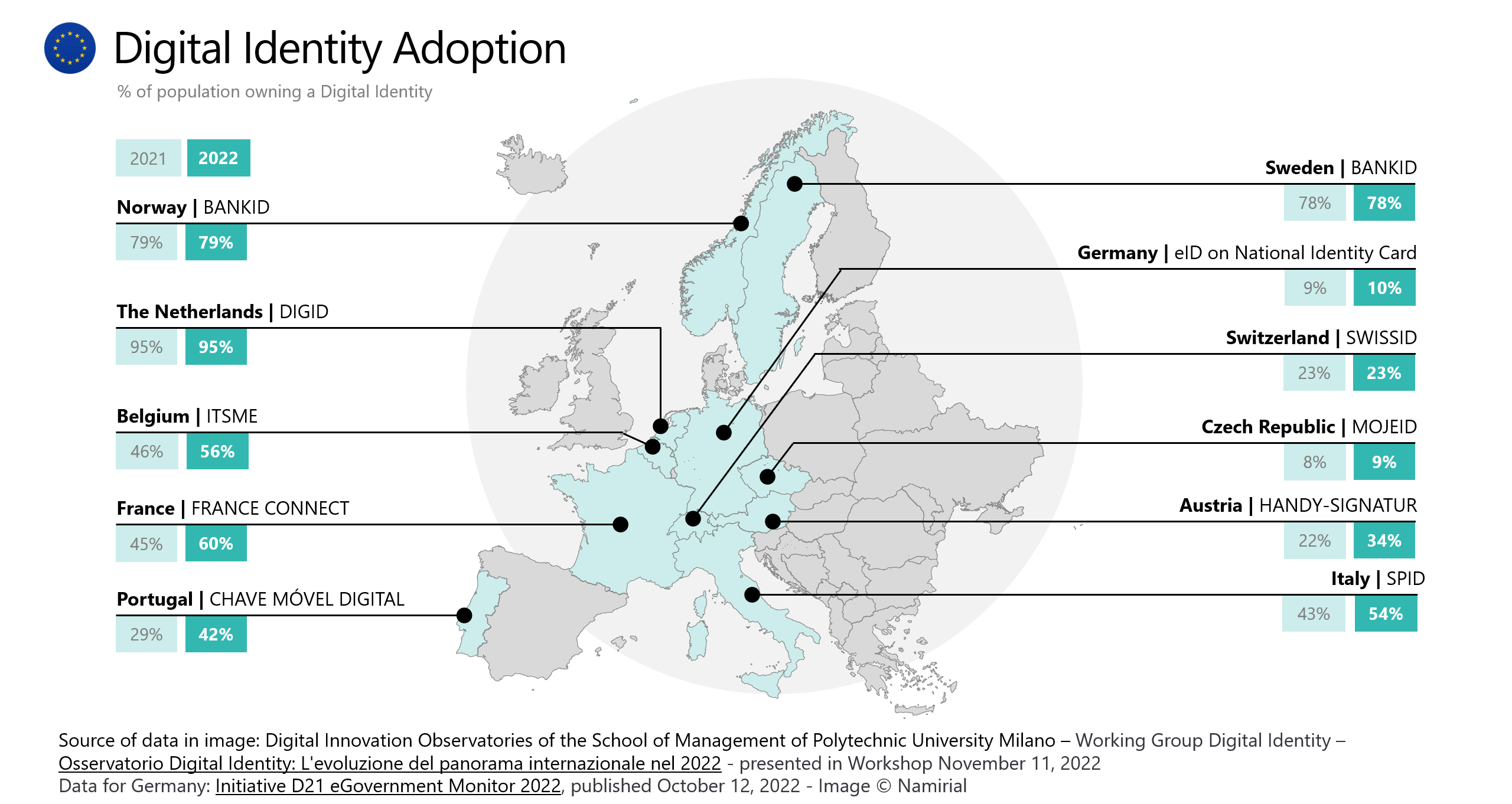

- By September 2022 54% of the Italian population was in possession of a digital identity, up from 43% in October 2021.

- The overall Italian adoption rate for digital identity is in a similar range with France (60%) and Belgium (56%) and far ahead of adoption rates in German-speaking countries.

- The highest adoption rate for digital identity among citizens in Europe was recorded in The Netherlands (95%), Norway (79%) and Sweden (78%).

Overall digital identity systems have continued the process of diffusion among users and companies. In 2022, some countries saw great progress in the use of digital identities. However, when looking at usage in the EU as a whole, growth in 2022 is significantly lower compared to growth in 2020 and 2021.

The digital identity adoption map below is primarily displaying systems not based on smart cards – with the exception of the German eID on national card which is expected to become also available as eID on smartphones (as “Smart-eID”) during the first half of 2023. The map is not providing a full overview of all systems but a snapshot of some important ones.

Italy’s success in digital identity adoption is primarily based on its Public Digital Identity System (Sistema Pubblico di Identità Digitale, SPID). This national system is enabling Italian citizens, persons with permanent residence permit and Italian businesses to access public administration services online.

- Italian citizens 18 years and older as well as foreigners holding a permanent residence permit and residing in Italy can apply for a digital identity in this scheme.

- Since September 2018 SPID is a system for electronic identities notified to the European Commision under EU Regulation 910/2014 on electronic identification and trust services (eIDAS).

- Namirial is one out of ten digital identity providers within this system, audited according to ETSI Technical Standard EN 391 401 by Bureau Veritas.

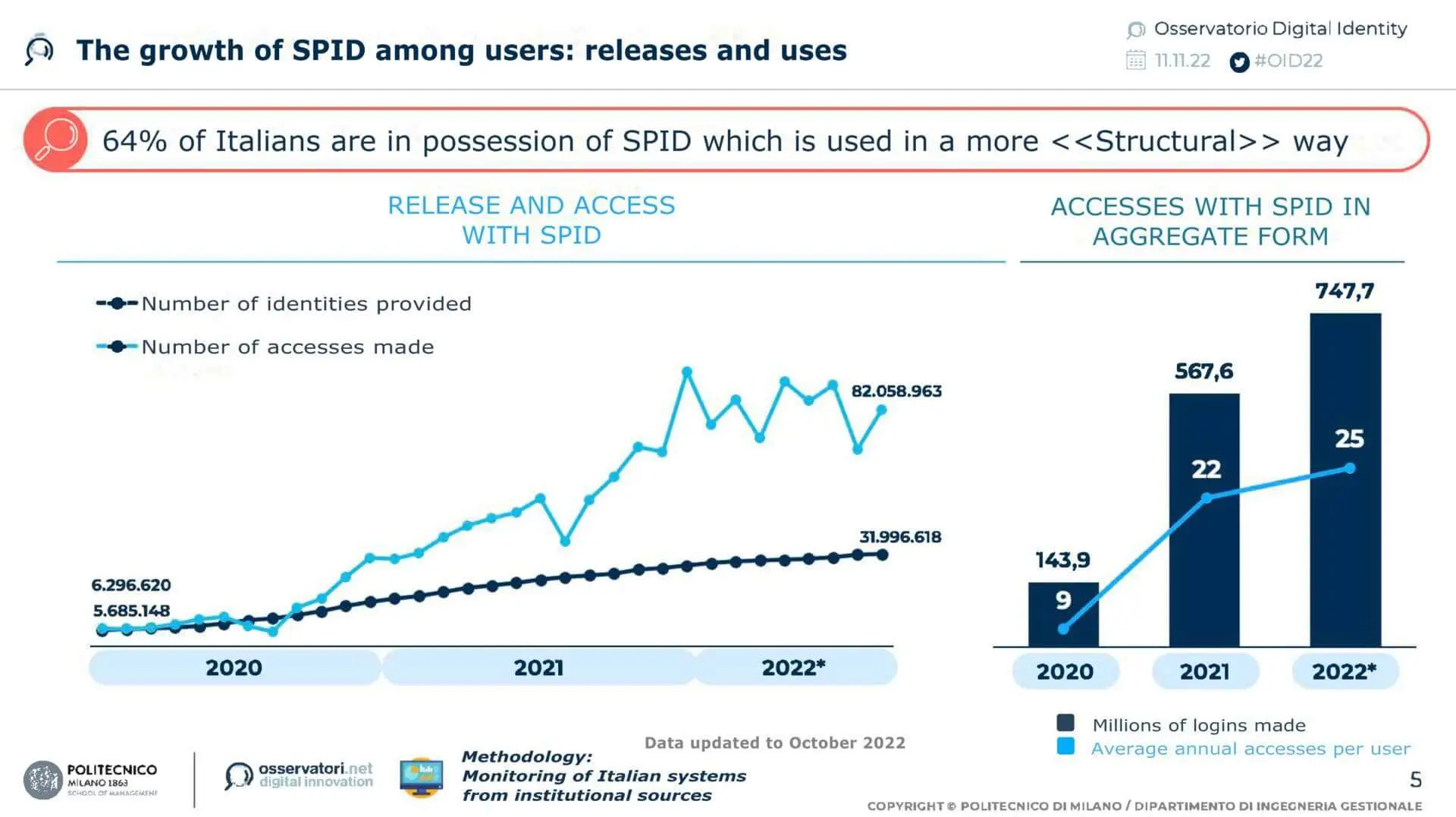

The following statistics have been presented by Digital Identity Observatory at a conference in Milan Polytechnic University November 11, 2022 plus we were adding some more data more recently published.

Usage of Italian Public Digital Identity System

The Public Digital Identity System SPID is by far the fastest growing scheme for digital identities in Italy with more users than the system for electronic identification based on Italy’s national ID card (Carta d’Identità elettronica, CIE).

- In late November 2022 the amount of digital identities issued in SPID was reaching a total of more than 33 million users – 63% of the adult population in Italy. All Italian citizens between 18 and 24 activated their digital identity. Among the population over 75 years less than 1 in 4 has yet activated their digital identity.

- From January to October 2022 the Public Digital Identity System reported 747.7 million accesses. The mark of 80 million accesses per month was surpassed in several months. SPID was used on average by Italians 25 times a year (22 times in 2021, 9 times in 2020).

- Using the digital identity for accessing services of government and private sector service providers became common. Use cases based on regulatory obligations, such as access to cashback schemes or Covid Green Pass are no longer the major drivers for using digital identity.

- Regions with highest adoption of Digital Identity are Lazio (74%) Lombardy (70%) and Emilia-Romagna, Campania and Piedmont (62%), lowest adoption is recorded in Molise (52%), Marche (53%) and Calabria (54%).

🔗 Digital Agency for Italy: Advancement of digital transformation (Page in Italian language)

Digital identity in public administrations and companies

The Public Digital Identity System is not only used by citizens, but also by public or private service providers.

- Over 12,000 public administrations are offering at least one service online through SPID by November 2022.

- 141 private companies had joined SPID by October 2022 (19 joined CIE). Potentially, almost 175,000 companies are interested in joining SPID, which shows the excellent growth opportunities that could arise in the near future.

The pandemic has prompted large companies to offer onboarding methods (i.e. remote recognition) to ensure business continuity, but we are still a long way from a mature and strategic vision of digital identity. 80% of large companies in the finance, telco and utility sectors allow you to start and finish the recognition procedure remotely and, in 80% of cases where it is necessary to verify the data entered by the user, carry it out without having to go to the counter.

Companies are starting to integrate recognition methods without passwords or pins, replacing them with ownership factors, such as sending via SMS or email with OTP code (42% of cases) or apps to generate OTPs or push notifications (18%). but also biometric factors (only 8% of cases). Even in more mature areas, however, there is a lack of an adequate internal structure that oversees the management of digital identity. And 63% of companies in these sectors have never evaluated the integration of nationally certified systems, such as SPID and CIE.

National Regulation in good Progress

Italy made some substantial progress in regulation use of digital identity in 2022:

- The role of private service aggregators has been defined, simplifying the membership process for companies from an administrative and technological point of view.

- Guidelines have been issued for managers of qualified attributes (such as professional registers and universities), who will be able to certify qualifications to be integrated into the dataset presented in the Public Digital Identity System.

Namirial best practices in driving adoption of digital identity

Namirial is accredited by Agency for Digital Italy (AgID) as one of ten identity providers for this electronic identity system, issuing and managing “Namirial IDs” – digital identities of natural and legal persons. Digital identities are being issued and corresponding credentials provided after successful verification of personal data.

Identification for electronic identity provisioning may be executed remote or in physical contact

- Based on electronic certificate for electronic signature – download and sign an application and upload it

- Based on electronic identity on Italian National Identity Card (Carta d’Identità Elettronica, CIE) — by using an NFC enabled smartphone and the CIEiD App

- Based on electronic certificate on Italian Health Card (Tessera Sanitaria, TS) or National Service Card (Carta Nazionale dei Servizi, CNS) – by inserting card into the reader and typing in the PIN

- Based on a video identification process in real time with a Namirial identification specialist

- Face to face by specially trained identification staff in Coop shops, and by appointment at Namirial’s offices in Italy and at Namirial’s headquarters in Senigallia.

Namirial is also supporting Professional SPID, a particular type of Italy’s Public Digital Identity System enabling legal professionals and companies to access the services of the public administration and private entities.

🔗 Detailed information on Namirial SPID offerings (in Italian language)

The next Big Thing: Digital Identity Wallets

In the digital identity market, the European Commission’s concept for a European digital identity framework (EUid) is widely welcomed. Wallets handling digital identities (“ID wallets”) will allow users to store them in an app on their smartphone in order to

- identify themselves online and offline

- store and present official information such as first name, last name, date of birth and nationality,

- store and share information from reliable private sources,

- use the information to prove a right, such as the right to reside, work or study in a particular Member State.

The upcoming revision of EU Regulation 910/2014 on electronic identification and trust services could form the basis for a real revolution in this market.

“The reference ecosystem of Digital Identity, worldwide, is undergoing a strong evolution towards increasingly interoperable and transnational digital identity systems” – explains Giorgia Dragoni, Director of the Digital Identity Observatory. “Both traditional subjects and BigTechs are moving in the direction of a Digital ID Wallet. The latter begin to see more business opportunities in secure and certified identities, they offer themselves as technological partners of institutional bodies in various countries, providing expertise on interoperability and usability of their applications, in addition to the vast user base that currently already uses the solutions they provide.”

Businesses should look at the impacts of Digital Identity Wallets now

Companies have so far worked in watertight compartments, developing non-interoperable systems and proceeding without an overview. Only 12% are considering the possibility of enhancing the identification profile of the end user to enable him to access other third-party services as well, in a wallet logic. The opportunities for using SPID and CIE are evidently still to be enhanced: despite all the regulatory interventions to make these systems more “attractive”,

“The Italian ecosystem must work to be ready for the change brought about by identity wallets – says Luca Gastaldi, Director of Digital Identity Observatories. “It is essential to develop greater sensitivity and awareness of the importance of an interoperable digital identity, to create synergies between sectors and between different national contexts.

At the same time, work must be done on SPID and CIE, so that they are ready for a competitive arena enlarged by regulatory developments. Delegating control over the technological assets and data contained in the wallet to the hands of a few players would cut us off from this change, effectively nullifying the effort to have created a system that puts the user and control over their data at the centre, distorting the national systems in which investments have been made in recent years, causing players who have so far developed services linked to digital identity to lose their position in the market”.